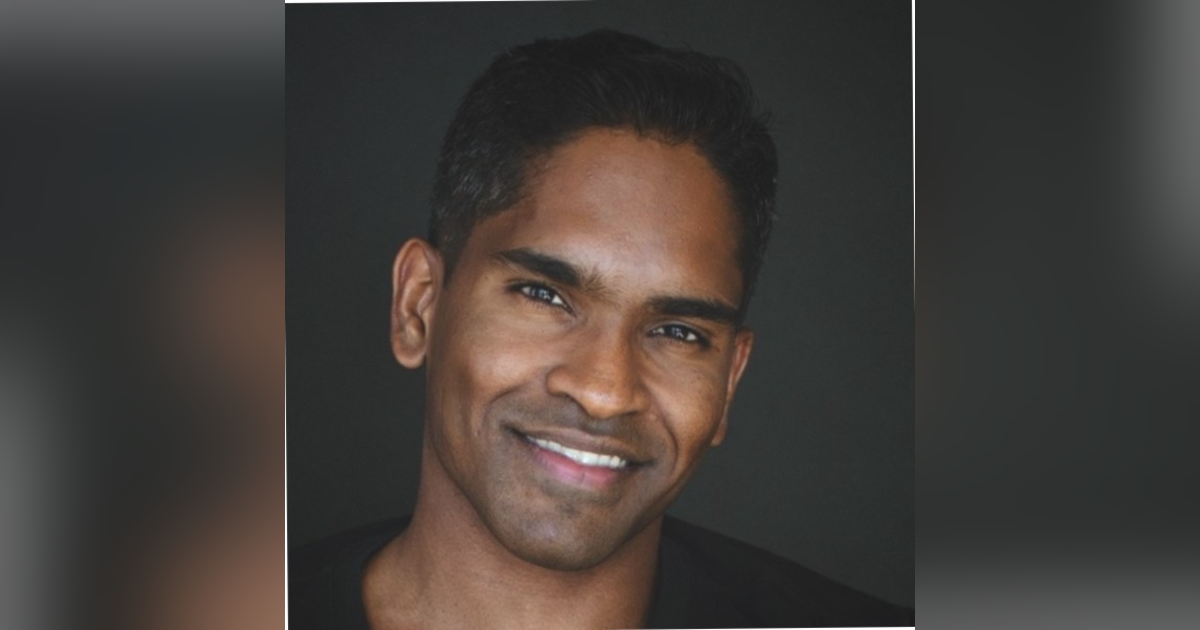

E64: Democratizing Financial Intelligence: Scaling Marketing for Financial Advisors with Jonathan Michael, CEO of Wealth I/O

In today's episode, we are joined by Jonathan Michael, the CEO of Wealth I/O, as we dive into the fundamentals of starting a business. With years of experience launching successful companies across multiple continents, Jonathan has a... See show notes at: https://www.remotestartpodcast.com/e64-democratizing-financial-intelligence-scaling-marketing-for-financial-advisors-with-jonathan-michael-ceo-of-wealth-io/#show-notes

In today's episode, we are joined by Jonathan Michael, the CEO of Wealth I/O, as we dive into the fundamentals of starting a business. With years of experience launching successful companies across multiple continents, Jonathan has a wealth of knowledge to share with our listeners.

We'll be discussing marketing strategies and how Jonathan's app, Wealth I/O, is helping financial advisors, registered investment advisors, and insurance agents scale their marketing efforts with efficiency. With a mission of democratizing financial intelligence, Jonathan is revolutionizing the way these professionals market their brands.

Join us as we explore the ins and outs of starting a successful business and learn valuable insights from a seasoned CEO. Tune in now to Remote Start Podcast with your host and fellow entrepreneur, and let's start the conversation!

Learn more about Jonathan Michael at:

LinkedIn: https://www.linkedin.com/in/jmjonathanmichael/

Website: https://wealthio.com/

Learn more about Remote Start Podcast at: https://www.remotestartpodcast.com/episodes/

Jim: Remote Start Nation, on today's episode, we are going to be discussing the fundamentals of starting a business with one CEO, who has launched several companies on several different continents. We are going to be discussing marketing strategies and how this CEO, his app helps financial advisors, registered investment advisors, as well as insurance agents market their brands today. Remote Start Nation, I'd like to welcome Jonathan Michael, CEO of Wealth I/O, who's on a mission of democratizing financial intelligence by helping financial advisors scale their marketing with efficiency. Jonathan, welcome to the Remote Start Nation.

Jonathan: Jim, thank you so much for having me on. It's a pleasure to talk to you today.

Jim: Yeah, absolutely man. You know what you've got, I did a little research, you've got quite the entrepreneurial journey you've been on. I'd love to hear more about it. How'd you start your first business?

Jonathan: Honestly, I think my entrepreneurial journey started in grade five when I rebelled against teachers and just wouldn't, do my homework on time and not write, not draw the lines in the right places. I think I was even talking to my mom, I was talking to my mom all year today and she was telling me about how, even growing up in school just wouldn't do things, according to the norm. And I think that kind of translated into my career unintentionally, it was not intentional. Like I had no clear plan that when I'm 21 or 22, I'm gonna start my first company or something like that. I think it was just a combination of a desire to have creative control and to build something out of nothing, the kick and the joy that comes out of building something from scratch. And, being able to envision whatever you want and build it, I think that's what really kicked off my desire to start my first company. We started with $200 in capital. This was back in India, so I'd gone to New Zealand for some school, okay. And then came back to India. And, I thought I was gonna get into the non-profit world and serve people there, but then my entrepreneurial drive was so strong. All the ideas that I had for bringing about societal change somehow revolved around entrepreneurship. And so I was gonna start a t-shirt brand, a premium t-shirt brand with this luxury cotton material, it's called CPMA. And I was gonna launch that t-shirt brand when I bumped into a family friend who wanted to launch a design school but needed someone to launch it with. So she had all the training and all the know-how, and, she thought that I could come on and help with sales and marketing and building an actual brand. Funny thing is I had the brand for the t-shirt company already set and because it was so much it was less capital intensive with the design score, so much less capital intensive. It just made sense for me as a 23 year old to, just jump on the design school wagon and get into your education building an educational company so to say. So we started off with $200 in capital, that's all I had. She didn't have anything either, I just had a little bit of money that I had, to start a business. And, we I remember launching my first Google AdWord campaign and that's how we got our first few leads, and I remember getting our first customer and I thought that was so incredibly funny. I don't know why I still remember that vividly, we were in a little conference room, we had rented a co-working space. We rented a co-working space and I remember being in the classroom there with that student and my co-founder and I got the first check from her and it was $300. So I thought that was hilarious because it was a hundred dollars more than capital, and then we, that's how we bootstrapped the company essentially. So that's how the journey began, this was in 2014, I believe.

Jim: Okay, that's awesome. And so that right there was your first real taste of running a business, starting a business, what were some of the challenges there that you had to overcome?

Jonathan: Wow, learning how to sell really well, I think for a first time entrepreneur you have an idea of how you need to sell, but then, I think learning how to communicate that marketing message clearly to my audience and finding the right distribution channels, that was difficult initially cuz I thought I'll just scale using AdWords and then turned out that AdWords was way too expensive. So I had to pivot into Facebook ads, and I had no idea about how to use Facebook ads, I think Gary V, Gary Vaynerchuk was my first coach in a way, I used to watch a lot of Gary V videos, like I used to binge watch Gary V videos because I had no idea about online marketing, and, I was like 23, 24, just trying to figure out, what we're gonna, what it was gonna look like to get new customers. And navigating Facebook ads was a challenge initially, but then learning how to launch lead generation campaigns, generating all those leads and then calling them up, call, calling them up. It was hard, but it was also fun. It was exciting, and obviously, as a first time entrepreneur doing a little bit of everything If you answer your question briefly, it was hard on every level. It was cash flow, management, marketing, sales. It was quite the journey. But yeah, it was very thrilling. It was extremely thrilling, it was a very thrilling journey, those first two years was incredibly thrilling, it was around year three that it started to get a little bit more difficult.

Jim: What was it that made it difficult?

Jonathan: That's a great question. Cash flow management, financial management, learning how to manage the cash flow of a small business is what I started to grapple with because you want to preserve as much cash as possible and you want to grow fast as well, but you don't wanna grow too fast. I made some bad decisions I think around year three, year four, to move into a much bigger space, more than what we could handle. âCause I was in the design business, right? I was in the design school business and I had a small office, a small training center, a thousand square feet of space, I'm like, you know what? I need 3000 square feet, I need to throw some Gucci around and show them that I've arrived. I wanna show people that I've arrived as a 26, 27 year old, your mind starts spinning and you get a little bit of success and you're like, you know what? I've arrived, I need to, let's scale this thing, let's scale this bad boy, so to say. And I think that's when a lack of financial wisdom started to, really, hurt that business, we also tried to pivot into an ed tech model, tried to, make a lot of our training online, but if I could trace it all back I could trace it back to that one point is learning how to manage cash flow and preserving cash flow more than anything else.

Jim: That's a great insight, and it's awesome that you can look back and understand that you made that mistake and learn from it.

Jonathan: It was a very hard lesson, it was extremely hard. But I think those five years running James School of Design and Business, that was my first company. It was like a bachelors in marketing and an MBA, both in one, I would say. Yeah, it was very thrilling, as I mentioned. And we had a lot of success, we grew 101% year on year for the first three years. But, those few financial decisions really affected us. And also, I must add, Jim, that there was an angel investor who wanted to throw in money for about 30, 40% of the company around year three, year four. And I was arrogant enough to not take that money because I thought that I could continue to scale the company without diluting any equity, turns out that. Turning into debt versus Angel money and ready, angel Capital was a really bad decision, and not consulting, not having a group of advisors, not having consultants that I could, get advice with through every stage of the business. I think that was another big mistake that I made and I would really recommend any first time founder, you are way more likely to succeed if you have advisors around you.

Jim: That's really good advice. How did those lessons that you learned, and even, on the pros and the cons, how did that lead into your second business in the business you're running now.

Jonathan: It really taught me to be, what's the right word? I'm not getting the word right now, but to be prudent, more prudent, okay. And conservative, and also it taught me patience and it taught me that, good things come with time and it's okay to wait a little longer. But cash is king, yeah, it's old school. It's, as today you have people who talk like the, your success as an entrepreneur is determined by how much capital you can raise or how much money you're burning and whatnot, and I think a lot of entrepreneurship is glamorized beyond the basics of business principles. And I think that hurts a lot of young people and it makes them have a very fantasized view of entrepreneurship, and I think I went through that too in my twenties and came to understand that wait a minute, you've gotta keep significant, you gotta have great cash flow, you've gotta have high profitability, you've gotta learn how to invest that money well into your business. And so I think I really use a lot of those lessons in my new business, but also leadership lessons. I think that, in your twenties you think you understand what it means to be a great leader, but then you really don't. Maybe there are some leaders who are able to do that in their twenties and be able to build a, big successful company and lead people really well but I think through my twenties I can even look back at some of the ways I led my staff, my employees, the kind of role model that I set for them, the kind of model that I set for them through my own leadership, through my own behavior. I feel like I learned a lot about what it means to be a great leader essentially, and I'm still learning how it is, and what it means to be a great leader. Honestly I feel like that's it, I'm in a relentless pursuit of becoming an excellent leader and learning what it means to be a great leader for my team. Yeah, I'm taking a lot of lessons from financial management, but also, what it means to be a great leader.

Jim: How many people are on your team now?

Jonathan: Three, we're a small startup.

Jim: Awesome. Tell me a little bit more before we get deeper into the business side and marketing side. Tell me more about, about your business, tell me about Wealth I/O.

Jonathan: Yeah, so we started about three years ago, again, this was something that I stumbled upon, I had no intentions of being a technology entrepreneur, coming from a non-technical background. My father-in-law worked as a financial advisor for about 32 years. And he had a lot of experience in the industry and he was struggling to, not struggling essentially, but he was trying to navigate what it would look like to scale his company online. And he was not able to make the necessary pivots that he needed to make in order to scale online because he was navigating this new world for himself. And we just got talking for fun. We started talking about different ideas for fun and, he was talking to me about how he wants to reach a hundred million American households, like he wants to, use his advisory business and probably even inspire the wider advisory community to meet this huge need that exists in America today for sound financial advice, for, financial coaching, financial guidance. And I started off, it was a fun project, we had no big, crazy, wild dreams to build a big company, we just, I just got involved for fun and one thing led to another. We built an MVP within the first few months with a very small amount of money, and then we kept investing more money in it. Had a really successful beta test with advisors here in America, and that's how we started to grow the company, yeah we've been very conservative.

Jim: That's incredible.

Jonathan: Growing very slowly intentionally because you look at a lot of other companies today, you look at Figma especially Figma and Amazon, all these companies, they took several years to really hit that sweet spot and I feel that's the same concept that we've applied here, is to really go slowly with actual users, try to understand those pain points they have on the ground, iterate the product. And continue to build a meaningful product that they would actually love using, and that's the approach we've applied to. I/O and we've been through several brand iterations, brand transformations. We again, as I mentioned before, decided as a project we were gonna sell it to one company, that was the plan That's it, okay. Yeah, because I had spent five years with my, with JM School of Design business, and I was gonna help my father-in-law on this project, we're gonna, build this marketing platform, it's gonna have these two, three products, they're gonna sell it to this enterprise company, done over. Okay. Yeah, because that was like, that's all I was willing to do, cuz that's what we had agreed on. But then turns out that it didn't plan, plans didn't go it, things go according to plan right when you're running a company, and I forgot that, I forgot that, things go, don't go according to plan and before you know it I'm like, oh my gosh. I need to be a technology entrepreneur, I need to run a full-fledged SaaS company, and so I was like, okay, what do I do now? A lot of education, a lot of training, talking with my other friends who run technology companies, phew. It's been quite the journey, and so through, after several pivots, several brand transformations, we are finally in a really good place now with a very clear marketing message, a very clear mission that we are proud of.

Jim: That's really cool. What were some of the things that your father-in-law was having an issue with, of trying to get in front of, these people that you saw, you looked at and you said, okay, there's a need here, this is actually something that technology can help with, what were a few of those issues or difficulties he was facing?

Jonathan: I would say it in one sentence, helping the average American today develop a clear financial vision for their lives. It's as simple as that because financial services is so sea loaded, it's so scattered, it's so confusing for the average American to navigate US household debt is on the rise, people are retiring later and later in life, and it is really trying to find a clear, simple, engaging marketing platform that added value to the average American. And drew them into the conversation with the advisor, positioning the advisor as a guide and a coach. As opposed to a salesperson.

Jim: So it's bridging that gap and letting them see that, Hey, this financial advisory is on my side.

Jonathan: There you go. Just, helping them see that they have a guide for the rest of their financial lives who gets them, who understands them, but who can deliver value to them before begging them to come on appointments. How many messages have you got from financial advisors on LinkedIn begging you for appointments or asking you for a 15 minute phone call? But how do I deliver value to these people first? But, and not just value through an ebook or email campaign, it's beyond that. It's about bringing people into an experience.

Jim: Yeah. And so that's, if I was to sum up, if we were to sell IO, is that what you've developed is that platform that allows for that?

Jonathan: Experience driven marketing technology.

Jim: Excellent. What are some of the things or the things you've had to overcome already, in building Wealth I/O?

Jonathan: Oh my gosh. Leading, God leading technical teams. I've been through a leader team of three now, but I've been through maybe 30 people in the last three years, 20 to 30 people. These are outsource teams, these are in-house employees. I literally have a chart that I look at every single day and that chart, one of the points on the chart is to recruit and verify a team, your team is everything, your team is a reflection of the company you're going to build, and so I've been very maniacal about the way I go about co team building, and so I think that was the most difficult part for me as a non-technical person trying to navigate a technical world, is trying to figure out who is gonna be that right team and do they see the vision of the company, and are they willing to work like a startup team? There's a difference between a startup team and there's a difference between a company team just like joining a big tech company, so to say, like Facebook. Yeah, like a Meta or an Instagram, those are two different worlds. So it's about, I think that was a huge challenge for me is trying to figure out who the right team is and also determining. What's the product market fit? What does product market fit look like? How do I build a product that actually fits with my market, with my intended audience? I think those are two huge curves that I've had to conquer, so to say.

Jim: With your team now, do you feel confident that, I know you, you already spoke on consistently challenging yourself to become a better leader. Do you feel like you have the right people in place that you know after going through 20, 30 different people in those seats that you're ready to scale, or take this to the next level?

Jonathan: Yeah, I think I have an amazing full stack developer's name is Harsh and an amazing product designer too, and they are sold out to the mission, as an early stage startup, as a company, as a small business you wanna find people who are going to work on weekends and not complain to you about it, it's just the way it is.

Jim: The work connects to you right next, like you're right there with them in the trenches.

Jonathan: You're right there with them in the trenches, but they also see the value of coming along and doing it with you, and it's not just monetary compensation, it's about the impact that they can bring into the marketplace. So the impact they can bring into the user's lives, and I think these few people that I have with me right now are really sold out to that, and I think the first 10 employees at the hire over the next 12 months will probably share the same mission and will be dedicated to that mission, but also I wanna, I'm glad you brought this up, Jim, because I also told my team I'm like, guys I had a different discussion with them about this. And I said, guys, let's be clear, okay. You only care about this company's mission so much, okay, come on, okay. Yeah, we can talk about mission and vision and all that because Steven Covey told us to do that, okay. And all these leadership experts, John Maxwell, told us to do that, okay. We, yeah, okay, whatever. But you are here, you're only here for yourself, okay? If you really look, if you really look deeper within you, were here working in this company, not because you care about democratizing financial intelligence to, a hundred million American households, you're only here because you want to grow your career, okay? Now, I know that you wanna serve this vision and this mission that's important, but if you don't become a better person as a result of being in Wealth I/O, then I failed at my job. And I don't know what the heck we're doing here. Yes, we wanna build a great company, but I want to have a legacy of having all the people around me also, grow tremendously. And so your purpose here is that you grow as well, and that you become super hot in the marketplace, like every company wants to hire you, that's my vision for you, that is my vision for you. If you get hired off of Belt io for five x, three x, four x your pay, then I've built a great company.

Jim: I love that, I absolutely love that. And I think if they can buy onto that and give you a certain amount of time and help, everybody's working together towards a common goal, but then also their own personal interest, I think that sounds like a win-win.

Jonathan: Right. I wanna make it about them as well. There's only so much you can say about mission and vision, some, at some point it becomes like, how are you empowering their personal mission and their personal vision? Because they have things in their own heart, they have, God has blessed them with potential too, they have their own innate potential. And as a founder, you are called to bring out the best in them, you're called to bring out the best in them for the company, but also for them both ways, and if you bring out the best for both of them, I think they're most likely to stay on with you, hopefully.

Jim: Yeah, yeah, hopefully. You had mentioned it before to me before the episode about, you think it's important to stick to the process of building the company and while you're at it, really finding a way to enjoy that process. Talk to me a little bit more about that.

Jonathan: Yeah, yeah, I get goosebumps, when I like, literally when I hear, I heard you just say that, for some reason just got some real goosebumps because that's been something very close to me. It's a company process, it is company building. We get so lost in the milestones that we don't realize that the milestones just last for a moment and we get so caught up with goals. I think goal setting today has become so toxic, you look at social media today, Instagram, TikTok, especially Gen Z millennials, but also Gen Z entrepreneurship is so glorified, you think that this is something that you put some coins in and then you get 10 coins back up, right? But it's not if you don't wanna make a lot of money, then start a startup, sorry. If you wanna make a lot of money, then don't start a startup, don't, right? Seriously, it's really hard, like your first few years, it's gonna be difficult, and if you don't enjoy the daily process of the boring and mundane product development, talking to customers, but selling about getting rejected every day. Then you are not gonna build something meaningful long term because you're just in here for the short term, grab. And I think the way I look at it, the way I look at it is a little bit more macro, I try to see company building processes as really a leadership journey for my own personal growth. I try to think of it as, yes, I want to enjoy this process. I want to enjoy it. What I'm called to do, I wanna enjoy my job as a startup, CEO, every day, even though it can be incredibly hard, I wanna enjoy this mundane things because I know that in the mundane, I'm gonna build up leadership muscle that's really gonna equip me to really scale and to do other things in the future. So I try to see this from a more macro level, and I embraced the suck, like how, David Hoggins yeah, I think I got the name right, David Hoggins. But he wrote this great book, this Goggins book, Goggins, sorry, in Hoggins. Yeah, Goggins, yeah, yeah, embrace the suck, right? But also joyfully embrace the suck. I would add another word there, at the joyful bit, joyfully embrace the stock because this process is what's gonna last the longest. There's one page that I read from the Tools of Titans every single day, I've read it for the last four years by Tim Ferris, right? Tool The Titans by Tim Ferris, and it talks about how your processes last the longest, and it's important to enjoy and embrace that process because the milestones only last for a shot bit. So if you don't enjoy the process, you, if you reach the first and second milestone, you're gonna feel happy and you're gonna, I don't know what, slack off. But yeah, if you enjoy the process, the daily company building process of the mundane, of the boring and find joy in it and find purpose in it, then I think you'll build something great long term.

Jim: Yeah. That's awesome, let's stick on you for a second, I know as entrepreneurs, as leaders and founders, personal health is such an important thing and something. I know for me I try to stick to a routine, sometimes that's easier. And other times it's a lot harder than it is said, but do you have a daily routine that you stick to that is, has been your foundational block of growth?

Jonathan: Yeah, again, great question. To answer your question briefly, yes. But a year ago, 18 months ago, I did a keynote speech for a company exactly on this topic, but I will try to simplify it more. And keep it adaptable for anyone because I think routines as well can be over glorified and people can get easily intimidated or overwhelmed when you tell them you wake up at 4:00 AM in the morning, what I've done is I've tried to keep it really simple. If you may have read James Clear. The book by James Clear, what's that famous habit book? I can't get the name right now, but James Clear, essentially that's the author's name, but he wrote a book about compounding personal development, compounding your personal growth, and I've applied the same principle to my life by just focusing on three things every day, my spiritual life is extremely important to me, so I wanna make sure I'm in line spiritually with my values and principles. Prayer is important for me, prayer, my physical life and my intellectual life. I just try to keep these three things every day. My goal is to get better, I'm here for the long term, okay? I wanna get 1% better every day, âcause if I can get 1% better every day, then by the end of 2024, I've got 365% better, right? So my daily routine is to get better, and yes, of course I believe in waking up early, I'm an izer. I love waking up early, it's so important for me, but I always, at the end of the day, my question is, did I work out today? Did I enjoy my physical health? Did I try to push myself physically? Did I learn something new? And do I feel spiritually connected? Because if I hit a home run on these three simple things, I call it the single decision framework, I make a single decision to get better, and my decision to get better is embedded with these three things. These three things are crucial for that, for me to get better. If I can focus on these three things, then my day will produce all the outcomes that it needs to produce, it'll produce the right emotions, it'll help me do the tasks that need to get completed, and I'll be primed for the day, essentially. So that's how I try to think of my daily routine, it's through those three simple principles, okay? Spiritual life, intellectual life, and your physical life, it's really simple, it's not it's not revolutionary, like people have done before, but I've simplified it as much as possible.

JIm: I'm with you when you wake up early. I used to be a night owl and try to stay up all night, then I'd sleep in, and when I was before moving to salt Lake in August, we were on the road for two years traveling in an RV, and I found that the only time that I could really get work done and be effective was when I got up early and I switched from staying up late to, getting up at 4, 4:30 every single day, and I've still continued to do that since we've been here and it's such a change.

Jonathan: Oh my God.

Jim: It is complete, my days are so much better than they used to be. As far as getting things accomplished, more time with that work-life balance because now I don't need to work while my kids are at home or whatever else. I've gotten my stuff done for the day. Yeah, I completely agree with you there. One thing I wanted to hit on, yeah. Oh, sorry. Go ahead.

Jonathan: No, I completely agree. Like waking up at 4:00 AM has been life changing, I like, I'm more happier, I'm just more happier as a result, there's something about the quiet in the morning. I never was a morning person, I had to hire a coach to help me become a morning person, it was a huge change for me, this was like, yeah, two and a half years ago, I hired a coach and I'm like, yo, job is to make me wake up, make up, wake up in the morning. He was a leadership coach with a Yale degree and whatnot, and he was like, what? That's all I need to do, I'm like, yep, that's all you need to do, waking up at 5:00 AM. And changed my life.

Jim: Yeah. Do you find yourself, I know the biggest thing with me is it's so hard to stay up late now, like I'm like 9, 9:30. I am exhausted.

Jonathan: Yep. My wife and I decided that we are going to look at what average people do and do the exact opposite. We're gonna try to not watch it, not watch anything, but we're gonna sleep and we are gonna start to read something now, so we started to do that off late. Cause sometimes you wanna just, you wanna, wind down watching something fun, but, nah, not gonna fly.

Jim: Let's have you had any mentors in your business? Is there anyone that you've surrounded yourself with that you know you could speak on? And what has that done for your business?

Jonathan: I am in the pursuit of that. Honestly, I don't have mentors, but I would love, love, love to have mentors who can really pour into my life. I am intentionally pursuing that, honestly, even since last week I've been trying to reach out to certain people in my life to help me with my spiritual growth and also my physical growth, so to say. But really, on a business level, there is a board of advisors that we have reached out to that we have that we are in the process of, appointing to the board. I don't have mentors who have been a huge part of my life. My best friends function like mentors to me, honestly. I have two amazing friends. One is still in India and the other one is in Singapore, but they mean the world to me and they honestly have really helped mentor me in several areas of my life. Right now I do have a few digital mentors. The All In podcast, you may have heard of it. There's an amazing podcast that is breaking the internet in Silicon Valley especially, but I look up to those four guys. They have built something significant with their lives and they digitally mentor me through YouTube.

Jim: That's cool. No, it's good to have, it's good to have, either people or, maybe it's an author, maybe like you said, it's a podcast or a vlog or something that you can look up to and get advice from, I feel like as entrepreneurs, a lot of time we feel like we're on this island, and I think it's so good to be able to. To find someone that you can go out and rely on, how did you, that kind of brings me to my next question. You talked about forming a board of advisors. Did you reach out one-on-one and say, Hey, I really feel like this could be a good fit. What kind of advice could you give to the Remote Start Nation on that?

Jonathan: Yeah, I look for domain experts in the mice industry, but I also looked at a few individuals. Who are part of our company building journey and who may not be like the typical hot pick or an or for an advisory board seat. But, they genuinely love what you've built and they genuinely want to support you. So it's one thing to bring on domain experts, but people, but also try to look for advisors who have your best in mind, who have no agenda, who are just here to help you because they'll love what you've built, they'll love you and they care for you. But also, yeah, get domain experts. So we reached out to a few domain experts in our industry who have an existing network of potential customers for us but also people who can help in our product development journey as a technology company. So that's how we went about the process, we try to be strategic about it, we've not officially appointed them to the board yet, I think in the next few months we'll have them appointed.

Jim: That's awesome. Let's talk about your app, Wealth I/O. And more general, just marketing, what are financial advisors? What are some of the things that they need to do to get out there and get in front of their audience?

Jonathan: Position yourself as a guide, position yourself as someone who can bring incredible value to you, immediately and to do that creatively through a mobile first experience driven medium. So one of the things that, one of the products that we offer is really we give advisors their own marketing app. Here's an app, a super app, it has financial wellness tools built into it. It has amazing content that's gonna educate your prospects for free. It's your app, it brands you. So I think advisors and wealth management professionals, asset managers, insurance agents, I think their job in the next five, 10 years is evolving into thought leadership, intense thought leadership, and becoming great educators âcause AI and machine learning and a lot of technologies today are gonna do a lot of the heavy lifting that was typically done, Through social media, whatever, right? Advisors need to focus more on content creation, original content creation, and that technology facilitates that, and I think that's what we aim to do, as we want to empower the next 5,000 registered investment advisors and instruments agents to reach 10 million people in the next five years, 10 million households through our app.

Jim: Yeah, that's really good advice, and being that thought leader, I think that starts, and I just talked about this on a previous episode, but you have to have that foundation, you have to have, what it is that sets you apart, right? Who, how is someone going to connect with you? If everything's, if AI's out there and can give information and everything else, like what is it about your own personal brand or about your agency that sets you apart.

Jonathan: Right, because right now you can, through chatGPT four, you can essentially ask a question about your financial life or whatever you know, tips or questions you have, and have it answer, respond back, spit out this amazing, well-constructed text. So yeah, I think what's gonna make you different right? What's gonna make the advisor different is that they have a unique mosaic, they have a unique mosaic of all these different sources of information, and they're able to construct it in a way that's going to be emotionally binding, not emotionally binding, that's a wrong word, but it's gonna connect with the end. Customers, their end clients emotionally, that somehow that education and that knowledge and all those different data sources are gonna be conveyed through an actual human, but with emotion and empathy.

Jim: It's something that, there has to be a commonality there too. Like I know for me, I want a financial advisor that is into the things that I'm into and can help me, let's talk about mentorship. Maybe it's somebody that has the things that I want in life and I know that they're giving me the best advice so I can get there because they've done that themselves, and so that's, I think it comes down to finding yourself, developing your own personal brand of who you are and like you said, and really getting that information, bringing it together in a way that makes sense to best serve. So yeah I really like that, I think that's a good move.

Jonathan: I think revealing your authentic self. I know we use the word authentic a lot these days, but it is really, truly being authentic online with original content, like you said, and letting people know who you are being able to do that clearly and letting technology facilitate that discussion. Like letting technology do a lot of heavy lifting, a lot of monotonous work that you should not be doing, like you should not be out in, you should not be looking at boring email campaigns, you should not be trying to figure out automations. You should not be trying to write a social media post. You should be able to let technology do a lot of that heavy lifting for you.

Jim: Yeah. No, it's a good point. Unfortunately, Jonathan, our time's coming to an end here. But before we go, where could people follow you on your journey? Where can they find you if they want to reach out and try to use Wealth I/O as an app?

Jonathan: Yeah. So yeah, you can go to Wealthio.com and you can sign up there for a free trial if you like or you can follow me on LinkedIn. Jonathan Michael, just search for Jonathan Michael on LinkedIn, I'm very active on LinkedIn, so yeah, we can connect there and I'd love to follow you as well and share about your journey. So yeah, please reach out to me there.

Jim: Awesome. Is there one thing, one last question I want to ask, and I ask this with every guest I have. If there's one thing that you wanna make sure that the entrepreneur's listening today takes with them, what would that be?

Jonathan: Love the person in front of you, love your customers, your employees, serve them and assist where needed. Show them that you're there to serve them as well, then challenge them, challenge them with a compelling vision, challenge them with goals, and then talk to customers every week, every day if you can, and sell like crazy. Five things, love, serve, challenge, talk to customers, sell like crazy.

Jim: Awesome. Jonathan, thank you so much for hanging out with us today, it was an honor and I really appreciate your time.

Jonathan: Thank you, Jim, this is a lot of fun, appreciate it.

Jim: Awesome, and you're very welcome. Remote Start Nation, I hope you learned as much as I did today and can put some of what Jonathan shared with us to work for you from the bottom of my heart. I wanna thank you all for joining us on this journey as we help you to start your business, grow your brand, and create your desired lifestyle.

Remember, leave a comment, subscribe, and share this episode with your community who you think could learn from what you heard today. Until next time, go start something, start it today, and go build the lifestyle you desire by taking action.

Jim Doyon

Entrepreneur

My name is Jim Doyon. I'm a father to three awesome kids, husband to an incredible wife and the oldest sibling to a large split family.I'm currently on a mission and I can't wait to share with you. We sold our house back in 2020, and we've been traveling this beautiful country in a 42-foot Travel trailer ever since. We visited 34 states, and are about to embark on our second loop around the country, stopping at some of our favorite spots again, but also getting to see new areas that the US has to offer.We are trying to experience this life to its fullest spending quality time together. I'm running a business and building brands along the road. We've been fortunate enough on this journey to meet new friends, catch up with old friends and family on many of our stops. We love exploring each City from downtown's to the natural resources it has to offer. I'm passionate about mountain biking and it's not only in my way to get out and explore but to exercise, clear my head, think, and strategize.

Jonathan Michael

Founder-CEO

Founder-CEO at WEALTH I/O (Pre-seed funded company with a vision to help financial advisors scale their marketing with tech to meet the unmet financial needs of 50M American households)